Academic Activities

IEAS Academician Prof. Li Yang: Remarks on Chinese Finance in Boao Forum for Asia (BFA)

2018-04-12 | source:

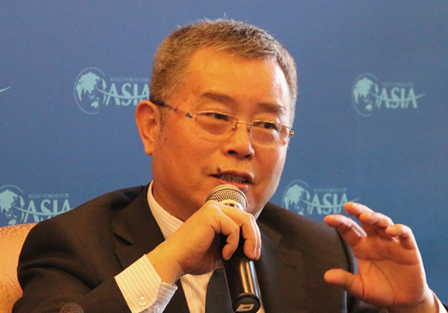

introduction:Prof. Li Yang, IEAS Academician, President of National Institute for Finance & Development, China is invited as the distinguished guest of Boao Forum for Asia (BFA) held 8th-11th, April 2018.

-

- IEAS Academician Prof. Li Yang: Remarks on Chinese Finance in Boao Forum for Asia (BFA)

-

Prof. Li Yang, IEAS Academician, President of National Institute for Finance & Development, China is invited as the distinguished guest of Boao Forum for Asia (BFA) held 8th-11th, April 2018.

When speaking of the impact of US monetary policy on China, Li says, there is indeed some impact, but China still has room to tackle this external shocks. After the Federal Reserve System raised interest rates, our inter-bank discount rate rose slightly, but we will not follow the US blindly, China will adjust accordingly by taking into full account its own situation. He also says, China's money supply structure is different from that of the US in that it has many regulatory factors. Just take required reserve as an example, China can lower the required reserve ratio to tackle with the impact of US monetary policy without changing the interest rates.

He adds, the ever high required reserve ratio results from the high foreign exchange reserve in the past years, however, time changes, so personally, I think the index should go down. Furthermore, by comparing with the US required reserve ratio (currently 2%), China has ample room to display.

When it comes to the RMB exchange rate, Li says, the CNY-USD indicator has becoming increasingly unreliable as the two currencies change dramatically nowadays. Therefore, we should make policies in accordance with the Basket of Currencies. He also says, years ago, Japan launches a trade war with the US by raising the value of the yen on a large scale, and this has led to "the lost 20 years" in Japan.

Finally, he concludes, at present, China's leverage ratio has been effectively controlled, and it is predicted that under the strong policy guidance in 2018, it will see a slight decline. China's debt problem is not particularly acute at the moment. He also warns the complexity of deleveraging by saying “the growth rate of household savings deposits is negative for the first time in history, and this is a very dangerous signal. If it continues to fall, it’s very likely to become a liability. Since the America's financial crisis began with household debt.”